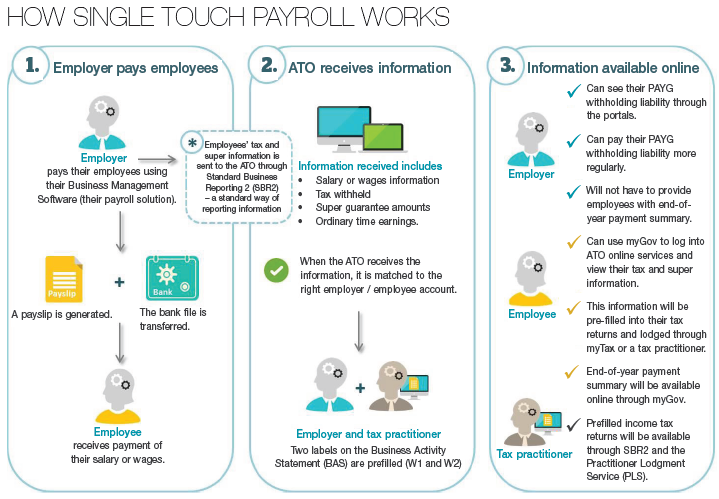

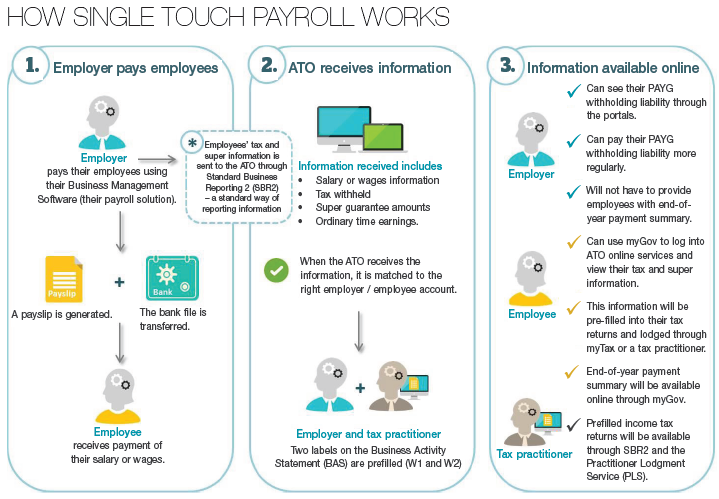

Single Touch Payroll is a government initiative to streamline business reporting obligations, which is due to become compulsory from 1 July 2018. When a business pays its employees, the payroll information will be sent to the ATO via the business’s payroll software.

Single Touch Payroll is a government initiative to streamline business reporting obligations, which is due to become compulsory from 1 July 2018. When a business pays its employees, the payroll information will be sent to the ATO via the business’s payroll software.

Reporting under the Single Touch Payroll (STP) system removes the requirement to issue payment summaries, provide annual reports and tax file number declarations to the ATO. During the first year of its introduction, the ATO says employers will not be liable for a penalty for a late STP report.

Important points to keep in mind for the transition to STP include:

- Employers with 20 or more employees will need to start reporting through STP from 1 July 2018.

- You will report salary or wages, pay as you go (PAYG) withholding and super guarantee information to the ATO when employees are paid.

- To determine if you are required to report through STP, you will need to do a headcount of employees on 1 April 2018 (more below).

- You may have the

option to invite employees to complete tax file number (TFN) declarations and super standard choice forms online

option to invite employees to complete tax file number (TFN) declarations and super standard choice forms online

- Payroll software will need to be updated to a version that supports STP.

- If your software was already STP enabled, you could have already been able to report through STP from 1 July 2017

EMPLOYER CHECKLIST TO HELP YOU GET READY

Step 1: Do a headcount of the employees you have on 1 April 2018 - Count the number of employees you have on your payroll on 1 April 2018 to find out if you are a "substantial employer'.'; If you have 20 or more employees on that date you will need to report through STP, (Se overleaf.)

Step 2: Update your payroll solution when it’s ready - Right now, payroll software and service providers are updating their products. A software product catalogue is available on the Australian Business Software Industry Association (ABSIA) website (search for “absia product catalogue”). The catalogue will be updated as payroll solutions are STP-enabled. You may wish to talk to your payroll software or service provider or third party provider for more information about your product, and when it will be ready.

Step 3: Start reporting through Single Touch Payroll - You can start reporting when your payroll solution is ready. Also note that:

- You will not be penalised. You will not be liable to pay a penalty for a late report during the first 12 month you are required to report through STP, unless the ATO first gives you written notice advising that a failure to report on time in the future may attract a penalty

- It’s okay if you make a mistake. When you start reporting through your STP-enabled payroll solution, you will be able to correct any errors you make in a later STP report.

- PAYG withholding payments. You will still have the option to pay your PAYG withholding more regularly, for example, when you pay your staff. However, there is no change to current payment due dates.

EMPLOYEE END-OF-YEAR PAY INFORMATION

If you report an employee's details through STP, you will not have to provide that employee with a payment summary at the end of the financial year. You also won't be required to provide the ATO with a payment summary annual report for those employee's details.

You will need to notify the ATO when the payment summary data is considered final. The ATO will make that information available to employees (and their tax agent) through myGov, and as pre-filled information in their tax return.

WHO IS AND !S NOT AN EMPLOYEE?

The following employees need to be included in the headcount:

- full-time employees

- part-time employees

- casual employees who are on the payroll on 1 April and worked any time during March

- employees based overseas

- any employee absent or on leave (paid or unpaid)

- seasonal employees (staff who are engaged short term to meet a regular peak workload - the ATO example is harvest workers).

When performing the headcount, the following are not included:

- any employees who ceased work before 1 April

- casual employees who did not work in March

- independent contractors

- staff provided by a third-party labour hire firm

- company directors

- office holders

- religious practitioners.

option to invite employees to complete tax file number (TFN) declarations and super standard choice forms online

option to invite employees to complete tax file number (TFN) declarations and super standard choice forms online